Pair Trading Lab Portfolios

Contents |

Introduction

Portfolio is in the terms of our website a group of pair trading strategies traded together. Strategies are independent but the parent portfolio controls money management rules. Also the portfolio has some additional settings and rules applied on all child strategies.

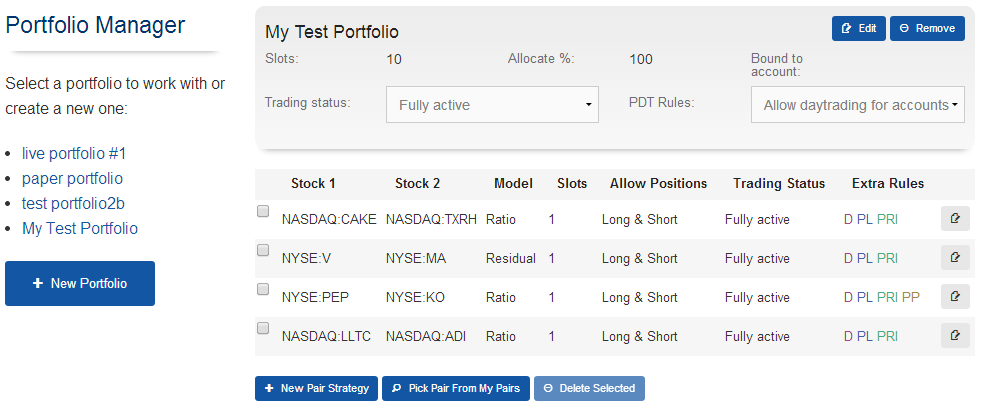

You can manage portfolios in the Portfolio Manager section of the website as long you are a Premium Member.

At this moment the only use of portfolios is to trade them in real-time using the PTL Trader application. But later, there will be more features available - you will be able to backtest and optimize whole portfolios. But we are not there yet, this is a future concept.

So, the portfolio is a group of pair trading strategies. You can imagine situation like this:

- Portfolio: Live Portfolio

- MSFT-AAPL, Ratio Model, MA Period: 15, StdDev Period: 15, ...

- MA-V, Ratio Model, MA Period: 25, StdDev Period: 25, ...

- KO-PEP, Residual Model, Linreg Period: 30, ...

- F-GM, Residual Model, Linreg Period: 35, Entry Threshold: 1.5, ...

- Portfolio: Paper Portfolio

- GLD-GDX, Residual Model, Linreg Period: 30, ...

- SPY-QQQ, Ratio Model, MA Period: 15, StdDev Period: 15, ...

- Portfolio: Another portfolio

- INTC-AMD, Ratio Model, MA Period: 15, StdDev Period: 15, ...

So, it means, that pairs MSFT-AAPL, MA-V, KO-PEP, F-GM are to be traded live together, sharing money management rules.

Portfolios are just groups of trading strategies, until you bind them to IB account in PTL Trader. Then they are executed using PTL Trader on your IB account, until you unbind them.

Portfolio, which is not bound to any IB account:

- may be modified or deleted using Portfolio Manager

- may be modified using PTL Trader application

- strategies may be modified, deleted or added using Portfolio Manager

- strategies may be deleted using PTL Trader

- some strategy properties may be modified using PTL Trader

- may be bound to an IB account in PTL Trader

Portfolio, which is already bound to an IB account:

- new strategies may be still added using Portfolio Manager

- strategies may be deleted using PTL Trader

- some strategy and portfolio properties may be modified using PTL Trader

- may be unbound from an IB account in PTL Trader

Start license allows users to use two IB accounts at the same time, so two portfolios may be bound to an IB account at the same time.

Portfolio Properties

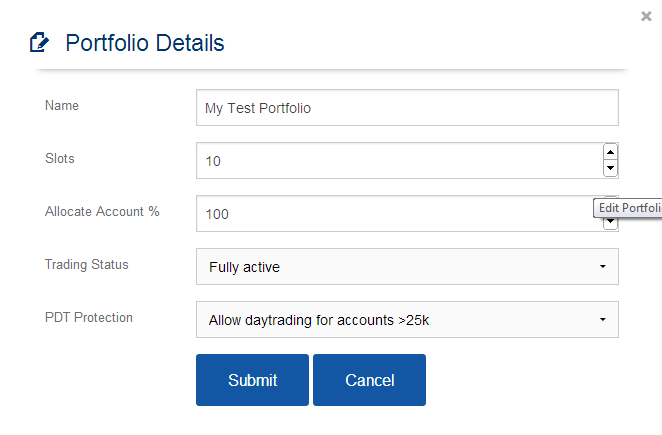

There are some properties you can set for the portfolio:

- Name = your portfolio name

- Slots = how many slots are available to your portfolio (see the Money Management chapter below for details).

Please note that you cannot change number of slots available once you bind a portfolio to an IB account!

- Allocate Account % = how many % of your IB account you allocate to this pair portfolio (see the section below for details)

- Trading Status (only effective if portfolio is bound to an IB account):

- Fully active = portfolio is active, and all strategies are traded automatically, if the same is enabled for them

- No new positions = no new positions are opened for the whole portfolio

- Fully inactive = trading paused for the whole portfolio

Please note the setting with more restriction power has the priority. If you set the portfolio to Fully active and strategy to No new positions, No new positions is applicable to the strategy. If you set the portfolio to No new positions and strategy to Fully active, again - No new positions is applicable to the strategy, too.

- PDT Protection (only effective if portfolio is bound to an IB account):

- No daytrading = pairs are never closed on the same day as they were opened

- Allow daytrading for accounts > 25k = daytrading is allowed for accounts with immediate equity greater or equal to 25,000 USD

Please read more about IB PDT Rules if you are not familiar with them.

Money Management

Pair strategies grouped in a portfolio share same management rules. You can imagine the Portfolio is actually a manager and all strategies have to ask the manager if they can open a position and how big the position should be.

The money management used in our software is slot based. That means, you configure (per portfolio) how many slots are there. Typical value is in range in 5-15. So if you say, for instance, my portfolio has 5 slots available, you say there can be max 5 standard pair positions opened at the same time. So it does not matter, how many active strategies you have in your portfolio - the system guarantees, there will never be more than 5 slots used = max 5 pair opened at the same time. If all slots are used, it means you already have 5 pairs opened and your account margin is used up to the maximum safe limit. In this situation, no new pairs are opened until some other position is closed.

Why we have slots instead of just saying how many pairs can be opened at the same time? Slots make it more flexible. Imagine situation, where you have pairs with very nice recent profit experience, on the other hand you have some pairs which are not so good recently. With slots, you can say - the first pair strategy works very well, so let's boost it and give it more weight - for instance, you can say it will occupy two slots instead of one. On the other hand, for not-so-good pairs, you can assign only half of the slot to it, until it gets better.

Actually, setting the slot occupation for pair strategy is equivalent to adjusting the money management weight. You can change the slot occupation in range from 0.1 (10% of the slot) to 2.0 (200% of the slot). Default occupation is 1, which means 1 slot = 1 pair.

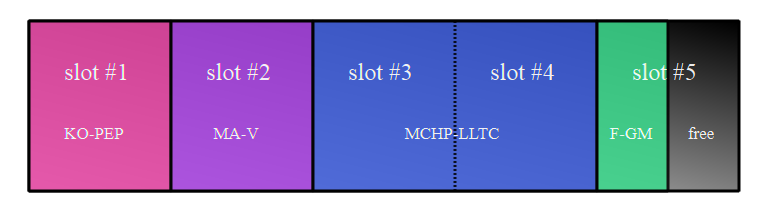

Let's look at some example. Imagine a portfolio with 5 slots configured, running on account having balance of 10,000 USD. Then the situation might look like this:

One slot in this case represents account balance of 10000/5 = 2000 USD.

- first slot is used by opened KO-PEP position, slot occupation is 1.0

- with margin of 50%, 2000 USD is allocated to KO position, 2000 USD is allocated to PEP position

- second slot is used by MA-V position, slot occupation is 1.0

- with margin of 50%, 2000 USD is allocated to MA position, 2000 USD is allocated to V position

- third and fourth slot is used by MCHP-LLTC position, slot occupation is boosted to 2.0 (two slots are used for this position)

- with margin of 50%, 4000 USD is allocated to MCHP position, 4000 USD is allocated to LLTC position

- a half of the last slot is used by F-GM position, slot occupation is lowered to 0.5 (only a half of the slot is used for this position)

- with margin of 50%, 1000 USD is allocated to F position, 1000 USD is allocated to GM position

- another half of the last slot is still free - whenever an entry signal fires for any pair strategy with occupation <=0.5 (so it would fit the space), position can be opened immediately

Remark: In case there is no free slot space to open new positions, all strategies wait for the free space. When new slot space becomes available, new pair positions are opened in FIFO (first-in-first-out) manner.

Account Allocation

By default, 100% of your account is allocated to the portfolio bound to it. However, you can change this either in Portfolio Manager or PTL Trader and set it to lower value, if you want. For instance, you can assign only 50% of your account to the pair trading portfolio and use the rest of the account for another strategies. So if you set it to e.g. 50%, all slots of the portfolio will automatically scale down proportionally.

If you change this parameter for portfolio already being traded, the value will apply for new positions only.

Best Practices

These are some useful advises how to setup the money management:

- you should never assign more than 25% of your account to a single pair strategy; best recommended is <= 10%

- it is not a good idea to assign less than 1500 USD to a single pair strategy; commissions will eat significant part of your profit

Rules above imply some recommendations how many slots to use for which account sized (assuming Req-T margin used, considering you have at least 15 pairs in your portfolio):

- <10,000 USD - don't trade pairs at all, it is not worth it

- 10,000 - use 5 slots, consider it still quite risky (20% per strategy is still quite high)

- 15,000 - use 7-8 slots

- 20,000 - 9-10 slots

- 25,000 - 10-13 slots

- 30,000 - 10-15 slots

- 100,000 - 10-?? slots (depends how many pairs do you trade)

Remark: most pair strategies are in position only in about 30-45 percent of the time. So it is usually a good idea to have slightly more pair strategies than slots in your portfolio, so your slot space (and therefore account margin) is used more effectively over the time.