Difference between revisions of "Trading Pairs Based on Inverse ETFs"

| Line 3: | Line 3: | ||

Pair Trading Lab now supports trading pairs assembled of negatively correlated instruments where typically one leg is an [http://www.investopedia.com/terms/i/inverse-etf.asp inverse ETF]. You could trade these pairs with regular strategies (sometimes cointegration is manifested in these cases and backtests look good), but there is one problem with this approach - the strategy is '''no longer market neutral'''. | Pair Trading Lab now supports trading pairs assembled of negatively correlated instruments where typically one leg is an [http://www.investopedia.com/terms/i/inverse-etf.asp inverse ETF]. You could trade these pairs with regular strategies (sometimes cointegration is manifested in these cases and backtests look good), but there is one problem with this approach - the strategy is '''no longer market neutral'''. | ||

| − | In order to stay market neutral one has to invert | + | In order to stay market neutral one has to invert signals for one leg - so typically the strategy is either in long position for '''both legs''' or in short position for '''both legs''', unlike with the regular long/short or short/long scenario. |

| − | For practical reasons to get meaningful signals from models, you typically also need to transform prices of one of | + | For practical reasons to get meaningful signals from models, you typically also need to transform prices of one of legs (to "flip" the one of price streams). Pair Trading Lab now supports both features required. The transformation function is typically P<sub>new</sub> = A /P<sub>old</sub> + B. These coefficients don't really matter, default values are A=1000, B = 0.5. You just want to transform prices in the way the result looks like a real price and it is not too low or too high. In 99% cases you can stick with these defaults. |

| − | + | == Example Pair: EUM/EWH == | |

| − | Now some example: | + | Now some example: Let's present EUM/EWH pair assembled from regular ETF and an inverse ETF: https://www.pairtradinglab.com/analyses/VrSMQuM8pGcteuiH. |

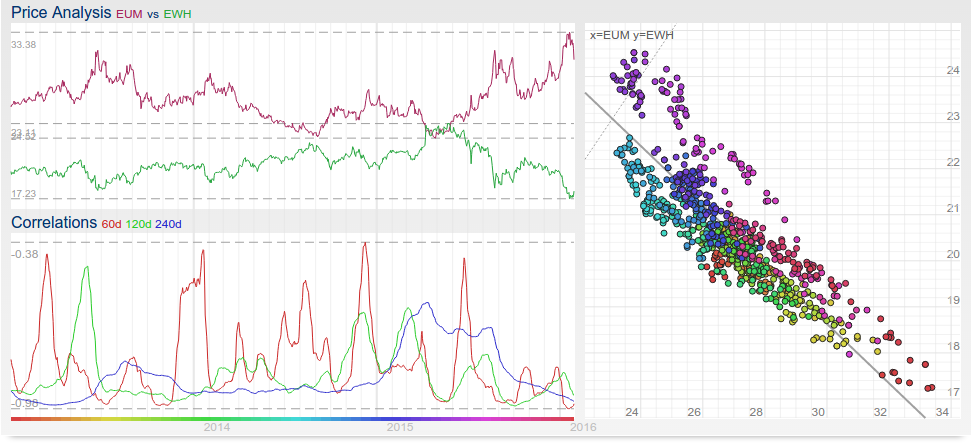

You can see prices manifesting negative correlation and β coefficient is negative: | You can see prices manifesting negative correlation and β coefficient is negative: | ||

| Line 23: | Line 23: | ||

[[File:Eum-ewh-transformation.png|center|frame|EUR/EWH price transformation P<sub>new</sub> = 1000 / P<sub>old</sub> + 0.1]] | [[File:Eum-ewh-transformation.png|center|frame|EUR/EWH price transformation P<sub>new</sub> = 1000 / P<sub>old</sub> + 0.1]] | ||

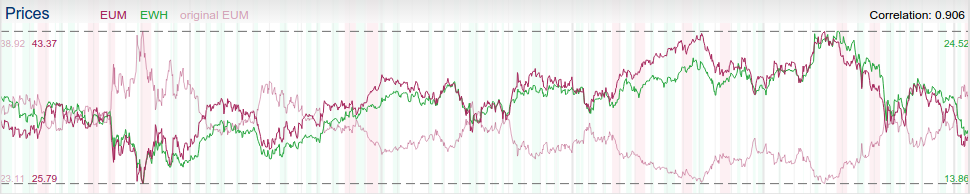

You can notice how the price transformation created a virtual instrument leading to positive correlation in the pair. Now see how this combo is being traded with long/long or short/short positions: | You can notice how the price transformation created a virtual instrument leading to positive correlation in the pair. Now see how this combo is being traded with long/long or short/short positions: | ||

| + | [[File:Eum-ewh-trade-log.png|center|frame|EUR/EWH trade log]] | ||

Revision as of 14:35, 7 February 2016

(this page is under construction)

Pair Trading Lab now supports trading pairs assembled of negatively correlated instruments where typically one leg is an inverse ETF. You could trade these pairs with regular strategies (sometimes cointegration is manifested in these cases and backtests look good), but there is one problem with this approach - the strategy is no longer market neutral.

In order to stay market neutral one has to invert signals for one leg - so typically the strategy is either in long position for both legs or in short position for both legs, unlike with the regular long/short or short/long scenario.

For practical reasons to get meaningful signals from models, you typically also need to transform prices of one of legs (to "flip" the one of price streams). Pair Trading Lab now supports both features required. The transformation function is typically Pnew = A /Pold + B. These coefficients don't really matter, default values are A=1000, B = 0.5. You just want to transform prices in the way the result looks like a real price and it is not too low or too high. In 99% cases you can stick with these defaults.

Example Pair: EUM/EWH

Now some example: Let's present EUM/EWH pair assembled from regular ETF and an inverse ETF: https://www.pairtradinglab.com/analyses/VrSMQuM8pGcteuiH.

You can see prices manifesting negative correlation and β coefficient is negative:

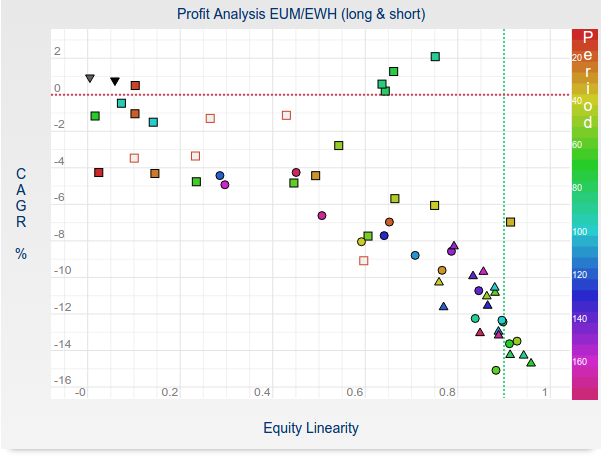

For this pair you can see that regular strategies do not appear to have much success:

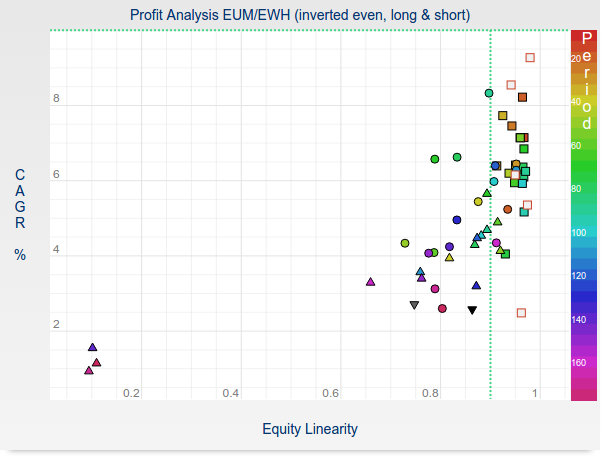

Now, let's try to look at inverted strategies with transformed prices:

It looks much better! Lets try to backtest one of the strategies with details: https://www.pairtradinglab.com/backtests/VrSOmXaMl8UYci6D

You can see quite stable performance for many years. Look at the price transformation:

You can notice how the price transformation created a virtual instrument leading to positive correlation in the pair. Now see how this combo is being traded with long/long or short/short positions: